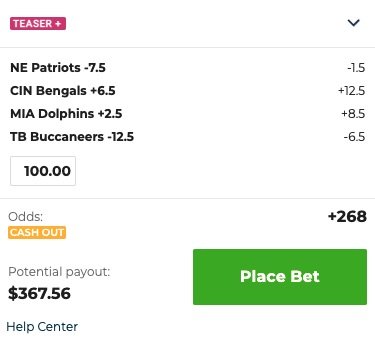

Juice in betting is an important aspect of gambling that many bettors aren't aware of. It's a way for sportsbooks to stay in business and cover their costs. It can also have an impact on the profitability of your bets, so make sure you are aware before placing any bets.

Bet The Juice

Bettors use this strategy to maximize profits. It involves betting higher amounts and choosing bets with lower odds. The long-term result can be a smaller loss or more profit.

What is the juice?

The juice in betting is a percentage cut that sportsbooks take off of your bet. It can be a small percentage or a large amount, depending on the sportsbook's payout structure. It's important to keep in mind that the bookmaker receives a small percentage even if they win.

What is Juice?

In the world of sports betting, juice is often used. However, it is also widely used in finance and in stock trading. This is one way sportsbooks make money by increasing their revenues.

When you bet on a sport, you are wagering on the outcome of a game between two teams. You can choose to bet the spread, total or moneyline. You can also wager on futures for upcoming sports events.

Odds represent the probability that any event will occur. The odds of a baseball match going to extra innings are slim. The game is likely to go over or below the total.

Spread betting can be profitable because the odds on the underdogs are higher than the favorites. Remember that odds are not fixed and are based on probabilities. You can also place bets on the futures exchange, but be sure to select the right odds.

Reduced Juice Betting

The majority of sportsbooks offer reduced juice on their regular betting lines. But it's not an absolute. It's important to research which sites offer lower vigs in different sports.

You will be asked to select the option of reduced vig when you register. The betting limits are also higher to encourage players to bet more.

These websites are also able to offer better customer service and faster payouts. These websites are often considered the best for sportsbooks with reduced vig.

Reduced Juice is Available on Most Online Sportsbooks

If you're looking for a sportsbook with reduced juice, there are several options to consider. These include GTBets, Pinnacle, and 5Dimes.

All of them have a great reputation in the industry of sports betting and accept bets up to $100,000. They also have a high average daily handle, which means that they have more than enough capacity to handle a high volume of bets.

FAQ

What side hustles are most lucrative in 2022?

The best way today to make money is to create value in the lives of others. If you do this well the money will follow.

It may seem strange, but your creations of value have been going on since the day you were born. You sucked your mommy’s breast milk as a baby and she gave life to you. The best place to live was the one you created when you learned to walk.

As long as you continue to give value to those around you, you'll keep making more. The truth is that the more you give, you will receive more.

Everyone uses value creation every day, even though they don't know it. It doesn't matter if you're cooking dinner or driving your kids to school.

In actuality, Earth is home to nearly 7 billion people right now. This means that every person creates a tremendous amount of value each day. Even if only one hour is spent creating value, you can create $7 million per year.

You could add $100 per week to someone's daily life if you found ten more. That would make you an additional $700,000 annually. You would earn far more than you are currently earning working full-time.

Now, let's say you wanted to double that number. Let's assume you discovered 20 ways to make $200 more per month for someone. You would not only be able to make $14.4 million more annually, but also you'd become very wealthy.

Every day there are millions of opportunities for creating value. This includes selling products, services, ideas, and information.

Even though we focus a lot on careers, income streams, and jobs, these are only tools that can help us achieve our goals. Ultimately, the real goal is to help others achieve theirs.

You can get ahead if you focus on creating value. Use my guide How to create value and get paid for it.

How do you build passive income streams?

To consistently earn from one source, you need to understand why people buy what is purchased.

It means listening to their needs and desires. This requires you to be able connect with people and make sales to them.

The next step is to learn how to convert leads in to sales. The final step is to master customer service in order to keep happy clients.

You may not realize this, but every product or service has a buyer. You can even design your entire business around that buyer if you know what they are.

You have to put in a lot of effort to become millionaire. You will need to put in even more effort to become a millionaire. Why? To become a millionaire you must first be a thousandaire.

Then you must become a millionaire. You can also become a billionaire. The same applies to becoming a millionaire.

So how does someone become a billionaire? Well, it starts with being a thousandaire. All you have to do in order achieve this is to make money.

Before you can start making money, however, you must get started. So let's talk about how to get started.

What is the limit of debt?

It is vital to realize that you can never have too much money. You'll eventually run out cash if you spend more money than you earn. It takes time for savings growth to take place. If you are running out of funds, cut back on your spending.

But how much is too much? Although there's no exact number that will work for everyone, it is a good rule to aim to live within 10%. You won't run out of money even after years spent saving.

This means that you shouldn't spend more money than $10,000 a year if your income is $10,000. You should not spend more than $2,000 a month if you have $20,000 in annual income. And if you make $50,000, you shouldn't spend more than $5,000 per month.

This is where the key is to pay off all debts as quickly and easily as possible. This includes student loans, credit card debts, car payments, and credit card bill. You'll be able to save more money once these are paid off.

You should also consider whether you would like to invest any surplus income. If the stock market drops, your money could be lost if you put it towards bonds or stocks. If you save your money, interest will compound over time.

As an example, suppose you save $100 each week. Over five years, that would add up to $500. You'd have $1,000 saved by the end of six year. In eight years, your savings would be close to $3,000 When you turn ten, you will have almost $13,000 in savings.

After fifteen years, your savings account will have $40,000 left. That's quite impressive. However, this amount would have earned you interest if it had been invested in stock market during the exact same period. You'd have more than $57,000 instead of $40,000

It's crucial to learn how you can manage your finances effectively. Otherwise, you might wind up with far more money than you planned.

What is personal finance?

Personal finance is about managing your own money to achieve your goals at home and work. This means understanding where your money goes and what you can afford. And, it also requires balancing the needs of your wants against your financial goals.

By mastering these skills, you'll become financially independent, which means you don't depend on anyone else to provide for you. You no longer have to worry about paying rent or utilities every month.

Learning how to manage your finances will not only help you succeed, but it will also make your life easier. It makes you happier. You will feel happier about your finances and be more satisfied with your life.

So, who cares about personal financial matters? Everyone does! Personal finance is one the most sought-after topics on the Internet. Google Trends indicates that search terms for "personal finance” have seen a 1,600% increase in searches between 2004-2014.

Today's smartphone users use their phones to compare prices, track budgets and build wealth. They read blogs like this one, watch videos about personal finance on YouTube, and listen to podcasts about investing.

In fact, according to Bankrate.com, Americans spend an average of four hours a day watching TV, listening to music, playing video games, surfing the Web, reading books, and talking with friends. That leaves only two hours a day to do everything else that matters.

You'll be able take advantage of your time when you understand personal finance.

Why is personal financial planning important?

For anyone to be successful in life, financial management is essential. We live in a world that is fraught with money and often face difficult decisions regarding how we spend our hard-earned money.

So why should we wait to save money? Is it not better to use our time or energy on something else?

Yes and no. Yes, because most people feel guilty if they save money. Because the more money you earn the greater the opportunities to invest.

As long as you keep yourself focused on the bigger picture, you'll always be able to justify spending your money wisely.

You must learn to control your emotions in order to be financially successful. If you are focusing on the negative aspects of your life, you will not have positive thoughts that can support you.

It is possible to have unrealistic expectations of how much you will accumulate. This is because your financial management skills are not up to par.

These skills will prepare you for the next step: budgeting.

Budgeting means putting aside a portion every month for future expenses. Planning will save you money and help you pay for your bills.

Now that you are able to effectively allocate your resources, you can look forward to a brighter future.

What side hustles can you make the most money?

Side hustles are income streams that add to your primary source of income.

Side hustles can be very beneficial because they allow you to make extra money and provide fun activities.

Side hustles not only help you save money for retirement but also give you flexibility and can increase your earning potential.

There are two types. Passive side hustles include online businesses such as e-commerce stores, blogging, and freelancing. Some of the active side hustles are tutoring, dog walking and selling eBay items.

Side hustles that make sense and work well with your lifestyle are the best. If you love working out, consider starting a fitness business. If you love to spend time outdoors, consider becoming an independent landscaper.

Side hustles can be found everywhere. Consider side hustles where you spend your time already, such as volunteering or teaching classes.

You might open your own design studio if you are skilled in graphic design. You might also have writing skills, so why not start your own ghostwriting business?

You should do extensive research and planning before you begin any side hustle. When the opportunity presents itself, be prepared to jump in and seize it.

Remember, side hustles aren't just about making money. They are about creating wealth, and freedom.

And with so many ways to earn money today, there's no excuse to start one!

Statistics

- These websites say they will pay you up to 92% of the card's value. (nerdwallet.com)

- As mortgage rates dip below 7%, ‘millennials should jump at a 6% mortgage like bears grabbing for honey' New homeowners and renters bear the brunt of October inflation — they're cutting back on eating out, entertainment and vacations to beat rising costs (marketwatch.com)

- Shares of Six Flags Entertainment Corp. dove 4.7% in premarket trading Thursday, after the theme park operator reported third-quarter profit and r... (marketwatch.com)

- 4 in 5 Americans (80%) say they put off financial decisions, and 35% of those delaying those decisions say it's because they feel overwhelmed at the thought of them. (nerdwallet.com)

- U.S. stocks could rally another 25% now that Fed no longer has ‘back against the wall' in inflation fight (marketwatch.com)

External Links

How To

Passive Income Ideas To Improve Cash Flow

There are many ways to make money online, and you don't need to be hard working. There are many ways to earn passive income online.

Perhaps you have an existing business which could benefit from automation. If you are thinking of starting a business, you might find that automating parts of your workflow can help you save time and increase productivity.

The more automated your business, the more efficient it will be. This will allow you to focus more on your business and less on running it.

Outsourcing tasks is a great method to automate them. Outsourcing allows your business to be more focused on what is important. When you outsource a task, it is effectively delegating the responsibility to another person.

This allows you to focus on the essential aspects of your business, while having someone else take care of the details. Outsourcing allows you to focus on the important aspects of your business and not worry about the little things.

A side hustle is another option. It's possible to earn extra cash by using your skills and talents to develop a product or service that is available online.

If you like writing, why not create articles? There are many places where you can post your articles. These websites allow you to make additional monthly cash by paying per article.

You can also consider creating videos. Many platforms let you upload videos directly to YouTube and Vimeo. Posting these videos will increase traffic to your social media pages and website.

You can also invest in stocks or shares to make more money. Stocks and shares are similar to real estate investments. You are instead paid rent. Instead, you receive dividends.

They are included in your dividend when shares you buy are purchased. The amount of dividend you receive depends on the stock you have.

You can reinvest your profits in buying more shares if you decide to sell your shares. In this way, you will continue to get paid dividends over time.