Juice in betting is an important aspect of gambling that many bettors aren't aware of. It is the money used by sportsbooks to cover expenses and keep their business running. It can also affect a bet's profitability, so it's best to learn about it before placing your bets.

Bet The Juice

It is a strategy that many bettors use to maximize their earnings. It entails wagering larger bet amounts and selecting selections with lower odds. Over time, this can lead to less loss and greater profit.

What is Juice?

Sportsbooks take a certain percentage of your wager as the "juice" in betting. It can be a small percentage or a large amount, depending on the sportsbook's payout structure. It's important to keep in mind that the bookmaker receives a small percentage even if they win.

What does the word juice mean?

Juice is a term that is commonly used in the sports betting industry, but it can also be used in other industries like finance and stock trading. It's a way that sportsbooks increase their profits and revenue by taking more bets.

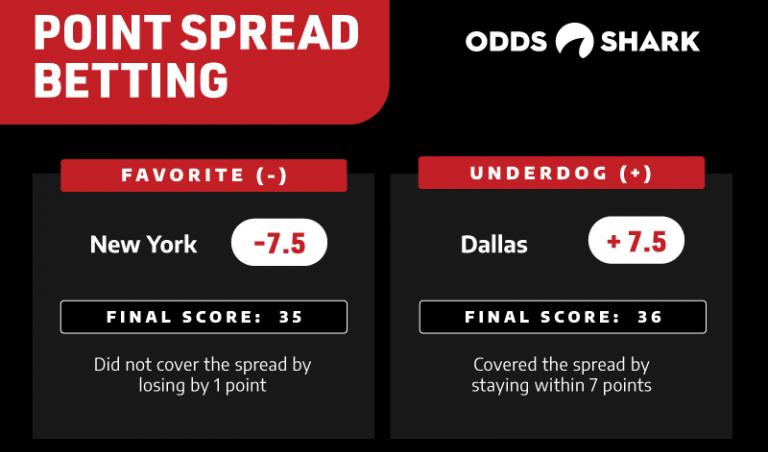

You are betting on a sports game when you place a bet. You can choose to bet the spread, total or moneyline. You can bet in futures markets on upcoming events.

Probability is a number which represents the likelihood of a certain outcome. The odds of a baseball match going to extra innings are slim. The total score of the game may also be higher or lower than the stated amount.

You can get juice on a spread bet because the odds are higher for the underdog than they are for the favorite. Remember that odds are not fixed and are based on probabilities. It is possible to bet in the futures market. However, it is crucial that you choose the correct odds.

Reduced Juice Betting

Most sportsbooks offer reduced juice for their regular betting lines, but it's not a given. Doing research is key to finding the best sites for each sport.

When you sign up, they will usually ask you if you want to choose the reduced vig option. They also offer higher betting limits, which encourages bettors wager more.

These websites can also provide faster payouts, better customer support and more. Many sportsbooks are rated as having the lowest vig.

Most online sportsbooks offer reduced juice

If you're searching for a sportsbook offering reduced juice, then there are a few options that you can consider. GTBets Pinnacle 5Dimes and Pinnacle are all options.

All of these sportsbooks have an excellent reputation and will accept bets from up to $100,000. A high average daily handling means that they are able to accept a lot of bets.

FAQ

What side hustles are the most profitable?

Side hustle is an industry term that refers to any additional income streams that supplement your main source.

Side hustles are important because they make it possible to earn extra money for fun activities as well as bills.

In addition, side hustles also help you save more money for retirement, give you time flexibility, and may even increase your earning potential.

There are two types. Passive side hustles include online businesses such as e-commerce stores, blogging, and freelancing. Some of the active side hustles are tutoring, dog walking and selling eBay items.

Side hustles are smart and can fit into your life. Consider starting a business in fitness if your passion is working out. If you love to spend time outdoors, consider becoming an independent landscaper.

There are many side hustles that you can do. Consider side hustles where you spend your time already, such as volunteering or teaching classes.

If you are an expert in graphic design, why don't you open your own graphic design business? Perhaps you're an experienced writer so why not go ghostwriting?

You should do extensive research and planning before you begin any side hustle. This way, when the opportunity arises, you'll be ready to jump right in and take advantage of it.

Side hustles aren’t about making more money. They can help you build wealth and create freedom.

There are so many opportunities to make money that you don't have to give up, so why not get one?

What is personal financial planning?

Personal finance involves managing your money to meet your goals at work or home. This involves knowing where your money is going, what you can afford, as well as balancing your wants and needs.

By mastering these skills, you'll become financially independent, which means you don't depend on anyone else to provide for you. You won't have to worry about paying rent, utilities or other bills each month.

Not only will it help you to get ahead, but also how to manage your money. It can make you happier. Positive financial health can make it easier to feel less stressed, be promoted more quickly, and live a happier life.

So who cares about personal finance? Everyone does! The most searched topic on the Internet is personal finance. According to Google Trends, searches for "personal finance" increased by 1,600% between 2004 and 2014.

People today use their smartphones to track their budgets, compare prices, build wealth, and more. These people read blogs like this one and watch YouTube videos about personal finance. They also listen to podcasts on investing.

Bankrate.com estimates that Americans spend on average 4 hours per day viewing TV, listening to music and playing video games, as well reading books and talking with friends. This leaves just two hours per day for all other important activities.

Financial management will allow you to make the most of your financial knowledge.

How much debt is considered excessive?

There is no such thing as too much cash. Spending more than what you earn can lead to cash running out. This is because savings takes time to grow. You should cut back on spending if you feel you have run out of cash.

But how much do you consider too much? While there is no one right answer, the general rule of thumb is to live within 10% your income. This will ensure that you don't go bankrupt even after years of saving.

This means that you shouldn't spend more money than $10,000 a year if your income is $10,000. If you make $20,000, you should' t spend more than $2,000 per month. For $50,000 you can spend no more than $5,000 each month.

It's important to pay off any debts as soon and as quickly as you can. This applies to student loans, credit card bills, and car payments. You'll be able to save more money once these are paid off.

It is best to consider whether or not you wish to invest any excess income. If the stock market drops, your money could be lost if you put it towards bonds or stocks. But if you choose to put it into a savings account, you can expect interest to compound over time.

As an example, suppose you save $100 each week. Over five years, that would add up to $500. After six years, you would have $1,000 saved. You'd have almost $3,000 in savings by the end of eight years. It would take you close to $13,000 to save by the time that you reach ten.

Your savings account will be nearly $40,000 by the end 15 years. This is quite remarkable. However, if you had invested that same amount in the stock market during the same period, you'd have earned interest on your money along the way. Instead of $40,000 you would now have $57,000.

That's why it's important to learn how to manage your finances wisely. A poor financial management system can lead to you spending more than you intended.

What is the difference in passive income and active income?

Passive income refers to making money while not working. Active income requires hard work and effort.

Active income is when you create value for someone else. When you earn money because you provide a service or product that someone wants. For example, selling products online, writing an ebook, creating a website, advertising your business, etc.

Passive income is great as it allows you more time to do important things while still making money. But most people aren't interested in working for themselves. Therefore, they opt to earn passive income by putting their efforts and time into it.

Passive income isn't sustainable forever. You might run out of money if you don't generate passive income in the right time.

You also run the risk of burning out if you spend too much time trying to generate passive income. It's better to get started now than later. You will miss opportunities to maximize your earnings potential if you put off building passive income.

There are three types to passive income streams.

-

There are several options available for business owners: you can start a company, buy a franchise and become a freelancer. Or rent out your property.

-

These investments include stocks and bonds as well as mutual funds and ETFs.

-

Real Estate: This covers buying land, renting out properties, flipping houses and investing into commercial real estate.

Why is personal finance so important?

If you want to be successful, personal financial management is a must-have skill. We live in a world that is fraught with money and often face difficult decisions regarding how we spend our hard-earned money.

Why should we save money when there are better things? Is there nothing better to spend our time and energy on?

The answer is yes and no. Yes because most people feel guilty about saving money. Yes, but the more you make, the more you can invest.

Focusing on the big picture will help you justify spending your money.

To become financially successful, you need to learn to control your emotions. Focusing on the negative aspects in your life will make it difficult to think positive thoughts.

Unrealistic expectations may also be a factor in how much you will end up with. This could be because you don't know how your finances should be managed.

Once you've mastered these skills, you'll be ready to tackle the next step - learning how to budget.

Budgeting means putting aside a portion every month for future expenses. Planning will allow you to avoid buying unnecessary items and provide sufficient funds to pay your bills.

Now that you understand how to best allocate your resources, it is possible to start looking forward to a better financial future.

What is the fastest way to make money on a side hustle?

If you want money fast, you will need to do more than simply create a product/service to solve a problem.

You need to be able to make yourself an authority in any niche you choose. It's important to have a strong online reputation.

The best way to build a reputation is to help others solve problems. Ask yourself how you can be of value to your community.

Once you have answered this question, you will be able immediately to determine which areas are best suited for you. There are many online ways to make money, but they are often very competitive.

However, if you look closely you'll see two major side hustles. One type involves selling products and services directly to customers, while the other involves offering consulting services.

There are pros and cons to each approach. Selling products or services gives you instant satisfaction because you get paid immediately after you have shipped your product.

However, you may not achieve the level of success that you desire unless your time is spent building relationships with potential customers. In addition, the competition for these kinds of gigs is fierce.

Consulting allows you to grow and manage your business without the need to ship products or provide services. But it takes longer to establish yourself as an expert in your field.

You must learn to identify the right clients in order to be successful at each option. This requires a little bit of trial and error. However, the end result is worth it.

Statistics

- 4 in 5 Americans (80%) say they put off financial decisions, and 35% of those delaying those decisions say it's because they feel overwhelmed at the thought of them. (nerdwallet.com)

- As mortgage rates dip below 7%, ‘millennials should jump at a 6% mortgage like bears grabbing for honey' New homeowners and renters bear the brunt of October inflation — they're cutting back on eating out, entertainment and vacations to beat rising costs (marketwatch.com)

- Mortgage rates hit 7.08%, Freddie Mac says Most Popular (marketwatch.com)

- These websites say they will pay you up to 92% of the card's value. (nerdwallet.com)

- U.S. stocks could rally another 25% now that Fed no longer has ‘back against the wall' in inflation fight (marketwatch.com)

External Links

How To

How to Make Money Even While You Sleep

It is essential that you can learn to sleep while you are awake in order to be successful online. This means learning to do more than wait for someone to click on your link or buy your product. It is possible to make money while you are sleeping.

You must be able to build an automated system that can make money without you even having to move a finger. This requires you to master automation.

You would benefit from becoming an expert at developing software systems that perform tasks automatically. So you can concentrate on making money while sleeping. You can automate your job.

The best way to find these opportunities is to put together a list of problems you solve daily. Then ask yourself if there is any way that you could automate them.

Once that's done, you'll likely discover that you already have many potential passive income sources. Now, you have to figure out which would be most profitable.

Perhaps you can create a website building tool that automates web design if, for example, you are a webmaster. Or if you are a graphic designer, perhaps you could create templates that can be used to automate the production of logos.

A software program could be created if you are an entrepreneur to allow you to manage multiple customers simultaneously. There are many options.

As long as you can come up with a creative idea that solves a problem, you can automate it. Automation is key to financial freedom.