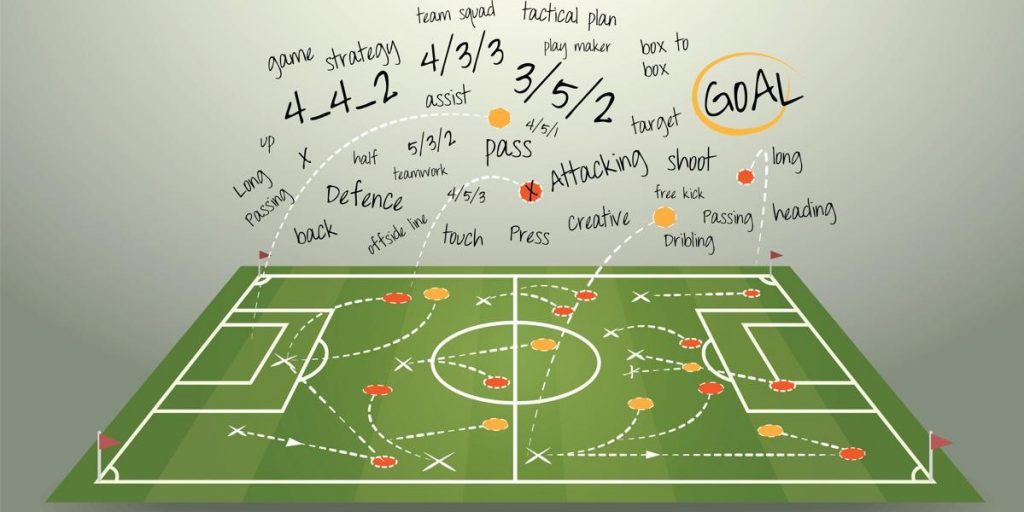

Understanding betting numbers is important for making informed decisions when you bet on sports. These numbers allow you to compare odds across different sportsbooks, and get the best value for your wagers.

The odds of winning can be in different forms depending on the sport. They include money lines and point spreads.

Bet Numbers

Money line is the most popular bet. A money line is a straight bet made on which team wins. These bets, available on all major sports, often have a minus symbol (-), followed by the plus sign (+), to indicate how much profit you can expect for each $100 bet.

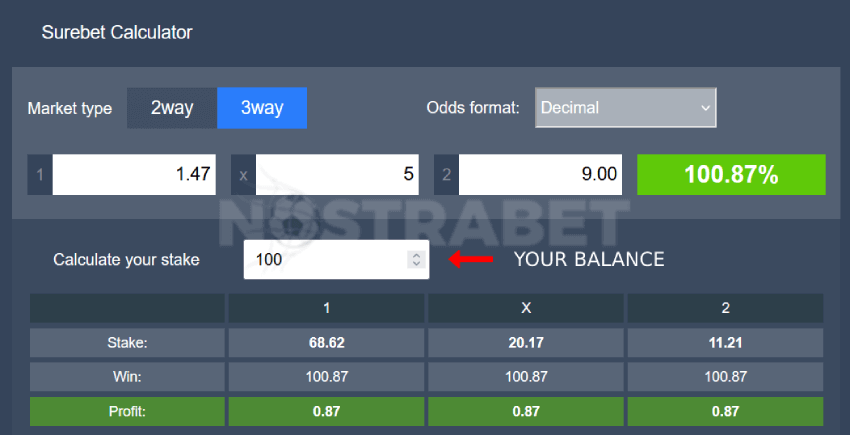

Decimal Odds

A decimal odds format is used for international events and sports such as the PGA tour and tennis tournaments. These odds display as a number and a decimal. They show the percentage win you get for each dollar bet.

NFL Key Numbers

When placing bets, sportsbooks will look at the three-point margin of victory as it is most common. The reason for this is that games with a margin of three points of victory are played about 14-15% more often and are therefore the most popular bets.

The key numbers will be more prevalent in basketball or baseball as these sports have lower scoring and less variance. They are especially useful in handicapping close matches that end on one score, like a run in Baseball or a goal for hockey.

Key numbers in basketball and baseball are more frequent than in football, but they're not as rigid or important as they are in spreads. They are, however, still relevant when handicapping over/under score totals.

Nfl Margin of Victory

If you're a fan of betting on football, you know that the most important point spreads are the 3-point and 7-point favorites. These numbers are vital for handicapping as they indicate how many point each team must win to win a wager.

They're also the most sought-after numbers by bettors. And they determine often which teams will win. It's so important that betting on these numbers is usually charged at a higher rate, particularly in the NFL.

Until the 2015 season, however, the thought was that two-point conversions and missed XPs would push these numbers lower on the chart, making it less valuable for the bettors. The new XP formula did improve the numbers but not completely.

They are still useful for handicapping the over/under total point count. If you understand the impact of line movement and missed kickoffs, then you can use this information to your advantage.

FAQ

What's the best way to make fast money from a side-hustle?

To make money quickly, you must do more than just create a product/service that solves a problem.

You also have to find a way to position yourself as an authority in whatever niche you choose to fill. That means building a reputation online as well as offline.

The best way to build a reputation is to help others solve problems. Consider how you can bring value to the community.

Once you've answered the question, you can immediately identify which areas of your expertise. There are many opportunities to make money online. But they can be very competitive.

You will see two main side hustles if you pay attention. The one involves selling direct products and services to customers. While the other involves providing consulting services.

Each approach has its pros and cons. Selling products or services gives you instant satisfaction because you get paid immediately after you have shipped your product.

The flip side is that you won't be able achieve the level you desire without building relationships and trust with potential clients. Additionally, there is intense competition for these types of gigs.

Consulting allows you to grow and manage your business without the need to ship products or provide services. It takes more time to become an expert in your field.

In order to succeed at either option, you need to learn how to identify the right clientele. This can take some trial and error. But, in the end, it pays big.

How does rich people make passive income from their wealth?

There are two ways you can make money online. You can create amazing products and services that people love. This is what we call "earning money".

The second way is to find a way to provide value to others without spending time creating products. This is known as "passive income".

Let's assume you are the CEO of an app company. Your job is to create apps. You decide to make them available for free, instead of selling them to users. This is a great business model as you no longer depend on paying customers. Instead, you rely upon advertising revenue.

You might charge your customers monthly fees to help you sustain yourself as you build your business.

This is the way that most internet entrepreneurs are able to make a living. Instead of making money, they are focused on providing value to others.

How much debt can you take on?

It is important to remember that too much money can be dangerous. You will eventually run out money if you spend more than your income. Because savings take time to grow, it is best to limit your spending. If you are running out of funds, cut back on your spending.

But how much can you afford? There's no right or wrong number, but it is recommended that you live within 10% of your income. You'll never go broke, even after years and years of saving.

If you earn $10,000 per year, this means you should not spend more than $1,000 per month. If you make $20,000 per year, you shouldn't spend more then $2,000 each month. Spend no more than $5,000 a month if you have $50,000.

It's important to pay off any debts as soon and as quickly as you can. This includes student loans and credit card bills. Once these are paid off, you'll still have some money left to save.

It is best to consider whether or not you wish to invest any excess income. You may lose your money if the stock markets fall. You can still expect interest to accrue if your money is saved.

Let's take, for example, $100 per week that you have set aside to save. That would amount to $500 over five years. Over six years, that would amount to $1,000. In eight years, you'd have nearly $3,000 in the bank. You'd have close to $13,000 saved by the time you hit ten years.

After fifteen years, your savings account will have $40,000 left. That's quite impressive. However, this amount would have earned you interest if it had been invested in stock market during the exact same period. Instead of $40,000, you'd now have more than $57,000.

It's crucial to learn how you can manage your finances effectively. If you don't, you could end up with much more money that you had planned.

What side hustles can you make the most money?

Side hustles are income streams that add to your primary source of income.

Side hustles provide extra income for fun activities and bills.

Side hustles may also allow you to save more money for retirement and give you more flexibility in your work schedule. They can even help you increase your earning potential.

There are two types: active and passive side hustles. Online businesses like e-commerce, blogging, and freelance work are all passive side hustles. Some examples of active side hustles include dog walking, tutoring and selling items on eBay.

Side hustles that make sense and work well with your lifestyle are the best. You might consider starting your own fitness business if you enjoy working out. You may be interested in becoming a freelance landscaper if your passion is spending time outdoors.

You can find side hustles anywhere. Find side hustle opportunities wherever you are already spending your time, whether that's volunteering or learning.

Why not start your own graphic design company? Or perhaps you have skills in writing, so why not become a ghostwriter?

Be sure to research thoroughly before you start any side hustle. When the opportunity presents itself, be prepared to jump in and seize it.

Side hustles aren’t about making more money. Side hustles can be about creating wealth or freedom.

There are so many ways to make money these days, it's hard to not start one.

What is personal finance?

Personal finance involves managing your money to meet your goals at work or home. It is about understanding your finances, knowing your budget, and balancing your desires against your needs.

If you master these skills, you can be financially independent. This means you are no longer dependent on anyone to take care of you. You're free from worrying about paying rent, utilities, and other bills every month.

You can't only learn how to manage money, it will help you achieve your goals. It will make you happier. Positive financial health can make it easier to feel less stressed, be promoted more quickly, and live a happier life.

What does personal finance matter to you? Everyone does! Personal finance is one of the most popular topics on the Internet today. Google Trends reports that the number of searches for "personal financial" has increased by 1,600% since 2004.

Today, people use their smartphones to track budgets, compare prices, and build wealth. They read blogs like this one, watch videos about personal finance on YouTube, and listen to podcasts about investing.

Bankrate.com estimates that Americans spend on average 4 hours per day viewing TV, listening to music and playing video games, as well reading books and talking with friends. That leaves only two hours a day to do everything else that matters.

You'll be able take advantage of your time when you understand personal finance.

What is the distinction between passive income, and active income.

Passive income means that you can make money with little effort. Active income is earned through hard work and effort.

You create value for another person and earn active income. If you provide a service or product that someone is interested in, you can earn money. For example, selling products online, writing an ebook, creating a website, advertising your business, etc.

Passive income allows you to be more productive while making money. However, most people don't like working for themselves. Therefore, they opt to earn passive income by putting their efforts and time into it.

Passive income isn't sustainable forever. If you wait too long before you start to earn passive income, it's possible that you will run out.

In addition to the danger of burnout, if you spend too many hours trying to generate passive income, It is best to get started right away. If you wait too long to begin building passive income you will likely miss out on potential opportunities to maximize earnings.

There are three types to passive income streams.

-

Businesses - these include owning a franchise, starting a blog, becoming a freelancer, and renting out the property such as real estate

-

These investments include stocks and bonds as well as mutual funds and ETFs.

-

Real Estate: This covers buying land, renting out properties, flipping houses and investing into commercial real estate.

Statistics

- According to the company's website, people often earn $25 to $45 daily. (nerdwallet.com)

- Etsy boasted about 96 million active buyers and grossed over $13.5 billion in merchandise sales in 2021, according to data from Statista. (nerdwallet.com)

- As mortgage rates dip below 7%, ‘millennials should jump at a 6% mortgage like bears grabbing for honey' New homeowners and renters bear the brunt of October inflation — they're cutting back on eating out, entertainment and vacations to beat rising costs (marketwatch.com)

- These websites say they will pay you up to 92% of the card's value. (nerdwallet.com)

- While 39% of Americans say they feel anxious when making financial decisions, according to the survey, 30% feel confident and 17% excited, suggesting it is possible to feel good when navigating your finances. (nerdwallet.com)

External Links

How To

You can increase cash flow by using passive income ideas

There are ways to make money online without having to do any hard work. Instead, you can make passive income at home.

Perhaps you have an existing business which could benefit from automation. If you are considering starting your own business, automating parts can help you save money and increase productivity.

The more automated your company becomes, the more efficient you will see it become. This allows you more time to grow your business, rather than run it.

Outsourcing tasks is an excellent way to automate them. Outsourcing allows your business to be more focused on what is important. You are effectively outsourcing a task and delegating it.

You can now focus on what is important to your business while someone else takes care of the details. Outsourcing makes it easier to grow your business because you won't have to worry about taking care of the small stuff.

It is possible to make your hobby a side hustle. Using your skills and talents to create a product or service that can be sold online is another way to generate extra cash flow.

Write articles, for example. There are plenty of sites where you can publish your articles. These sites pay per article and allow you to make extra cash monthly.

Another option is to make videos. Many platforms allow you to upload videos to YouTube or Vimeo. When you upload these videos, you'll get traffic to both your website and social networks.

One last way to make money is to invest in stocks and shares. Investing stocks and shares is similar investment to real estate. Instead of renting, you get paid dividends.

You receive shares as part of your dividend, when you buy shares. The amount of your dividend will depend on how much stock is purchased.

You can sell shares later and reinvest the profits into more shares. You will keep receiving dividends for as long as you live.