A vigorish is an amount that a sportsbook charges to help it make money. This is similar to the commission that you pay at retail stores when you purchase a product, or the markup charged by a stockbroker when you purchase shares.

What is a vig in gambling?

A vig is the amount that a bookmaker charges per bet. It is a fee the sportsbook charges in order to recover its losses and cover any risk of losing wagerers.

There are multiple ways to calculate a "vig". The most popular way to calculate a vig is by subtracting the winning percentage from a player's total bet. The greater the winning percentage of a bet, the more vig a bettor will pay.

The vigorish can be added or subtracted from winnings as well. For example, a bettors who wins 55% on their bets would only pay 4.55% as vigorish. This is why bettors should look for a bookmaker who doesn't charge a high percentage of vigorish.

How much does Vigorish cost?

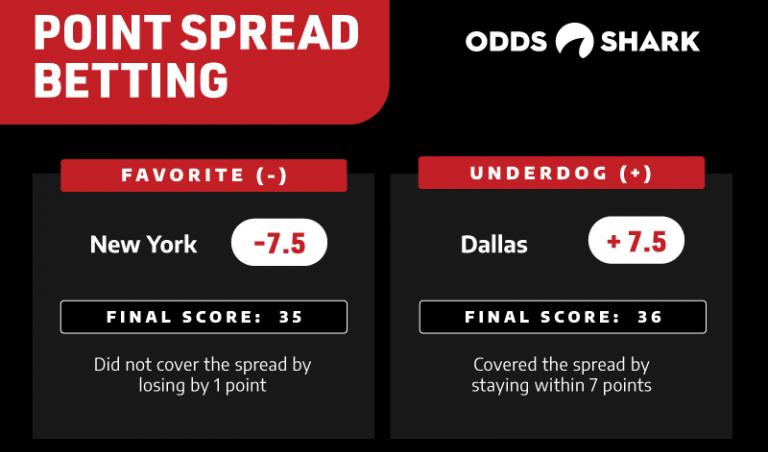

The cost of vigorish refers to the amount a bookmaker charges bettors for spread and totals. These bets typically have odds of -110. This means a bettor has to bet $110 in order to win $100.

You should also know the vigorish before placing any bets. It will help you understand whether the odds you're considering are reasonable and will help you decide if it's worth making a bet on a certain event.

Why Do I Want a Vigorous Calc?

It's crucial to understand the vigorish system and how it impacts your odds if you're new to sports betting. A vigorish calculator can help you calculate how much vigorish you'll need to wager in order to maximize your returns.

In the world of sports betting, vigorish is one of the most important terms that you should be familiar with. This fee is what sportsbooks charge for every bet, so it's vital to know how it affects your bottom line.

Why Do I Need a Sports Betting Vigorish Calculator?

A vigorish, or vigorishes, is a percentage paid by sports betting customers. This percentage varies from person to person, depending on the bettor's winning percentage and the odds they choose to bet. You can use the vigorish tool below to calculate how much vigorish will be charged when you bet an NFL team.

A vigorish-calculator is vital to make informed decisions about your sports betting. It will help you find the best odds to place your bets and avoid sportsbooks who charge high fees. This is particularly true if this is your first time betting on sports and you want to make money.

FAQ

What is the easiest way to make passive income?

There are many online ways to make money. But most of them require more time and effort than you might have. How can you make it easy for yourself to make extra money?

The answer is to find something you love, whether blogging, writing, designing, selling, marketing, etc. Find a way to monetize this passion.

For example, let's say you enjoy creating blog posts. Create a blog to share useful information on niche-related topics. You can sign readers up for emails and social media by clicking on the links in the articles.

This is affiliate marketing. There are lots of resources that will help you get started. Here's a collection of 101 affiliate marketing tips & resources.

A blog could be another way to make passive income. You'll need to choose a topic that you are passionate about teaching. However, once you've established your site, you can monetize it by offering courses, ebooks, videos, and more.

There are many ways to make money online, but the best ones are usually the simplest. You can make money online by building websites and blogs that offer useful information.

Once you have created your website, share it on social media such as Facebook and Twitter. This is what's known as content marketing. It's a great way for you to drive traffic back your site.

Why is personal finance so important?

Anyone who is serious about financial success must be able to manage their finances. We live in a world where money is tight, and we often have to make difficult decisions about how to spend our hard-earned cash.

Why do we delay saving money? Is there nothing better to spend our time and energy on?

Both yes and no. Yes, because most people feel guilty when they save money. No, because the more money you earn, the more opportunities you have to invest.

Focusing on the big picture will help you justify spending your money.

Financial success requires you to manage your emotions. You won't be able to see the positive aspects of your situation and will have no support from others.

Your expectations regarding how much money you'll eventually accumulate may be unrealistic. This is because you haven't learned how to manage your finances properly.

These skills will prepare you for the next step: budgeting.

Budgeting is the act of setting aside a portion of your income each month towards future expenses. Planning will help you avoid unnecessary purchases and make sure you have enough money to pay your bills.

You now have the knowledge to efficiently allocate your resources and can start to see a brighter financial future.

What is the difference between passive and active income?

Passive income refers to making money while not working. Active income requires hardwork and effort.

If you are able to create value for somebody else, then that's called active income. It is when someone buys a product or service you have created. Selling products online, writing ebooks, creating websites, and advertising your business are just a few examples.

Passive income can be a great option because you can put your efforts into more important things and still make money. Most people aren’t keen to work for themselves. Instead, they decide to focus their energy and time on passive income.

Problem is, passive income won't last forever. If you hold off too long in generating passive income, you may run out of cash.

If you spend too long trying to make passive income, you run the risk that your efforts will burn out. It's better to get started now than later. If you wait too long to begin building passive income you will likely miss out on potential opportunities to maximize earnings.

There are three types passive income streams.

-

These include starting a business, owning a franchise or becoming a freelancer. You could also rent the property, such as real-estate, to other people.

-

Investments - These include stocks, bonds and mutual funds as well ETFs.

-

Real Estate - These include buying land, flipping houses and investing in real estate.

What are the top side hustles that will make you money in 2022

The best way today to make money is to create value in the lives of others. If you do it well, the money will follow.

Even though you may not realise it right now, you have been creating value since the beginning. When you were a baby, you sucked your mommy's breast milk and she gave you life. When you learned how to walk, you gave yourself a better place to live.

You'll continue to make more if you give back to the people around you. In fact, the more you give, the more you'll receive.

Value creation is an important force that every person uses every day without knowing it. Whether you're cooking dinner for your family, driving your kids to school, taking out the trash, or simply paying the bills, you're constantly creating value.

In actuality, Earth is home to nearly 7 billion people right now. That's almost 7 billion people on Earth right now. This means that each person creates a remarkable amount of value every single day. Even if only one hour is spent creating value, you can create $7 million per year.

You could add $100 per week to someone's daily life if you found ten more. That would make you an additional $700,000 annually. That's a huge increase in your earning potential than what you get from working full-time.

Let's imagine you wanted to make that number double. Let's imagine you could find 20 ways of adding $200 per month to someone's lives. Not only would this increase your annual income by $14.4 million, but it also makes you extremely rich.

Every single day, there are millions more opportunities to create value. This includes selling products, ideas, services, and information.

Even though we focus a lot on careers, income streams, and jobs, these are only tools that can help us achieve our goals. The ultimate goal is to assist others in achieving theirs.

Focus on creating value if you want to be successful. Start by downloading my free guide, How to Create Value and Get Paid for It.

How does rich people make passive income from their wealth?

There are two main ways to make money online. You can create amazing products and services that people love. This is called "earning” money.

A second option is to find a way of providing value to others without creating products. This is called "passive" income.

Let's say you own an app company. Your job involves developing apps. But instead of selling them directly to users, you decide to give them away for free. This is a great business model as you no longer depend on paying customers. Instead, you rely on advertising revenue.

Customers may be charged monthly fees in order to sustain your business while you are building it.

This is the way that most internet entrepreneurs are able to make a living. They give value to others rather than making stuff.

How much debt can you take on?

It is essential to remember that money is not unlimited. You'll eventually run out cash if you spend more money than you earn. It takes time for savings growth to take place. When you run out of money, reduce your spending.

But how much should you live with? Although there's no exact number that will work for everyone, it is a good rule to aim to live within 10%. You won't run out of money even after years spent saving.

This means that even if you make $10,000 per year, you should not spend more then $1,000 each month. You should not spend more than $2,000 a month if you have $20,000 in annual income. For $50,000 you can spend no more than $5,000 each month.

It is important to get rid of debts as soon as possible. This includes student loans and credit card bills. Once these are paid off, you'll still have some money left to save.

You should consider where you plan to put your excess income. You may lose your money if the stock markets fall. However, if you put your money into a savings account you can expect to see interest compound over time.

For example, let's say you set aside $100 weekly for savings. Over five years, that would add up to $500. After six years, you would have $1,000 saved. You'd have almost $3,000 in savings by the end of eight years. You'd have close to $13,000 saved by the time you hit ten years.

At the end of 15 years, you'll have nearly $40,000 in savings. This is quite remarkable. If you had made the same investment in the stock markets during the same time, you would have earned interest. Instead of $40,000 you would now have $57,000.

You need to be able to manage your finances well. Otherwise, you might wind up with far more money than you planned.

Statistics

- These websites say they will pay you up to 92% of the card's value. (nerdwallet.com)

- According to a June 2022 NerdWallet survey conducted online by The Harris Poll. (nerdwallet.com)

- U.S. stocks could rally another 25% now that Fed no longer has ‘back against the wall' in inflation fight (marketwatch.com)

- While 39% of Americans say they feel anxious when making financial decisions, according to the survey, 30% feel confident and 17% excited, suggesting it is possible to feel good when navigating your finances. (nerdwallet.com)

- As mortgage rates dip below 7%, ‘millennials should jump at a 6% mortgage like bears grabbing for honey' New homeowners and renters bear the brunt of October inflation — they're cutting back on eating out, entertainment and vacations to beat rising costs (marketwatch.com)

External Links

How To

Get passive income ideas to increase cash flow

You don't have to work hard to make money online. Instead, there are passive income options that you can use from home.

You may already have an existing business that could benefit from automation. If you are considering starting your own business, automating parts can help you save money and increase productivity.

The more automated your company becomes, the more efficient you will see it become. This will enable you to devote more time to growing your business instead of running it.

Outsourcing tasks is an excellent way to automate them. Outsourcing allows for you to focus your efforts on what really matters when running your business. Outsourcing a task is effectively delegating it.

You can now focus on what is important to your business while someone else takes care of the details. Because you don't have to worry so much about the details, outsourcing makes it easier for your business to grow.

It is possible to make your hobby a side hustle. Using your skills and talents to create a product or service that can be sold online is another way to generate extra cash flow.

You might consider writing articles if you are a writer. There are plenty of sites where you can publish your articles. These sites allow you to earn additional monthly cash because they pay per article.

You can also consider creating videos. Many platforms enable you to upload videos directly onto YouTube or Vimeo. These videos can drive traffic to your website or social media pages.

Stocks and shares are another way to make some money. Investing is similar as investing in real property. However, instead of paying rent, you are paid dividends.

You receive shares as part of your dividend, when you buy shares. The size of the dividend you receive will depend on how many stocks you purchase.

If you sell your shares later, you can reinvest the profits back into buying more shares. You will keep receiving dividends for as long as you live.